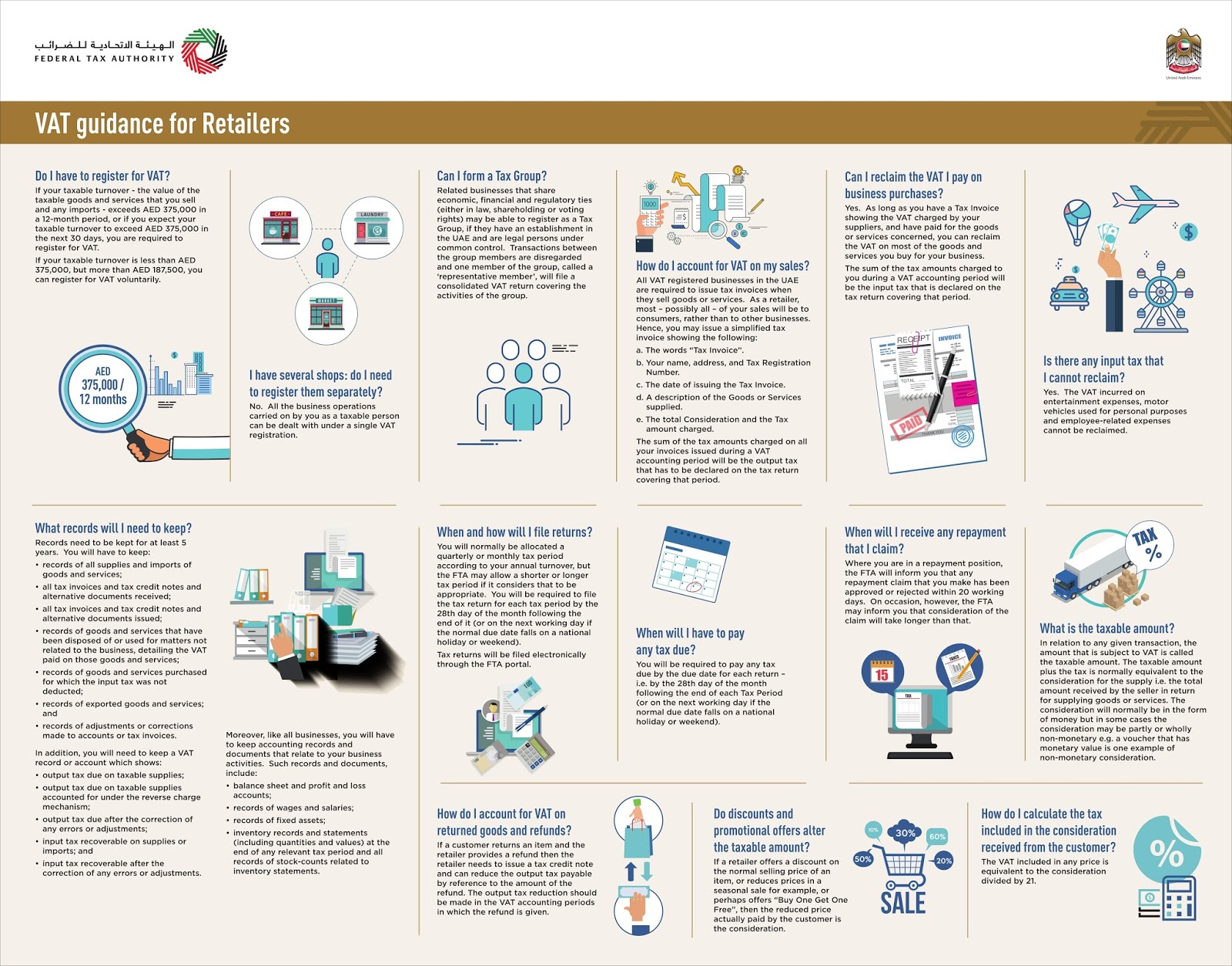

Value Added Tax (VAT) guidance for Retailers – VAT in UAE

Value Added Tax (VAT) guidance for Retailers published on Federal Tax Authority website www.tax.gov.ae. Do I have to register for VAT? If your taxable turnover – the value of the taxable goods and services that you sell and any imports – exceeds AED 375,000 in a 12-month period, or if you expect your taxable turnover to exceed AED 375,000 in the next 30 days, you are required to register for VAT. If your taxable turnover is less than AED 375,000, but more than AED 187,500, you can register for VAT voluntarily. I have several shops: do I need to register them separately? No. All the business operations carried on by you as a taxable person can be dealt with under a single VAT registration. Can I form a Tax Group? Related businesses that share economic, financial and regulatory ties (either in law, shareholding or voting rights) may be able to register as a Tax Group if they have an establishment in the UAE and are legal persons under common control. Transactions between