TechVista Systems implements VAT for Twenty-Two organizations

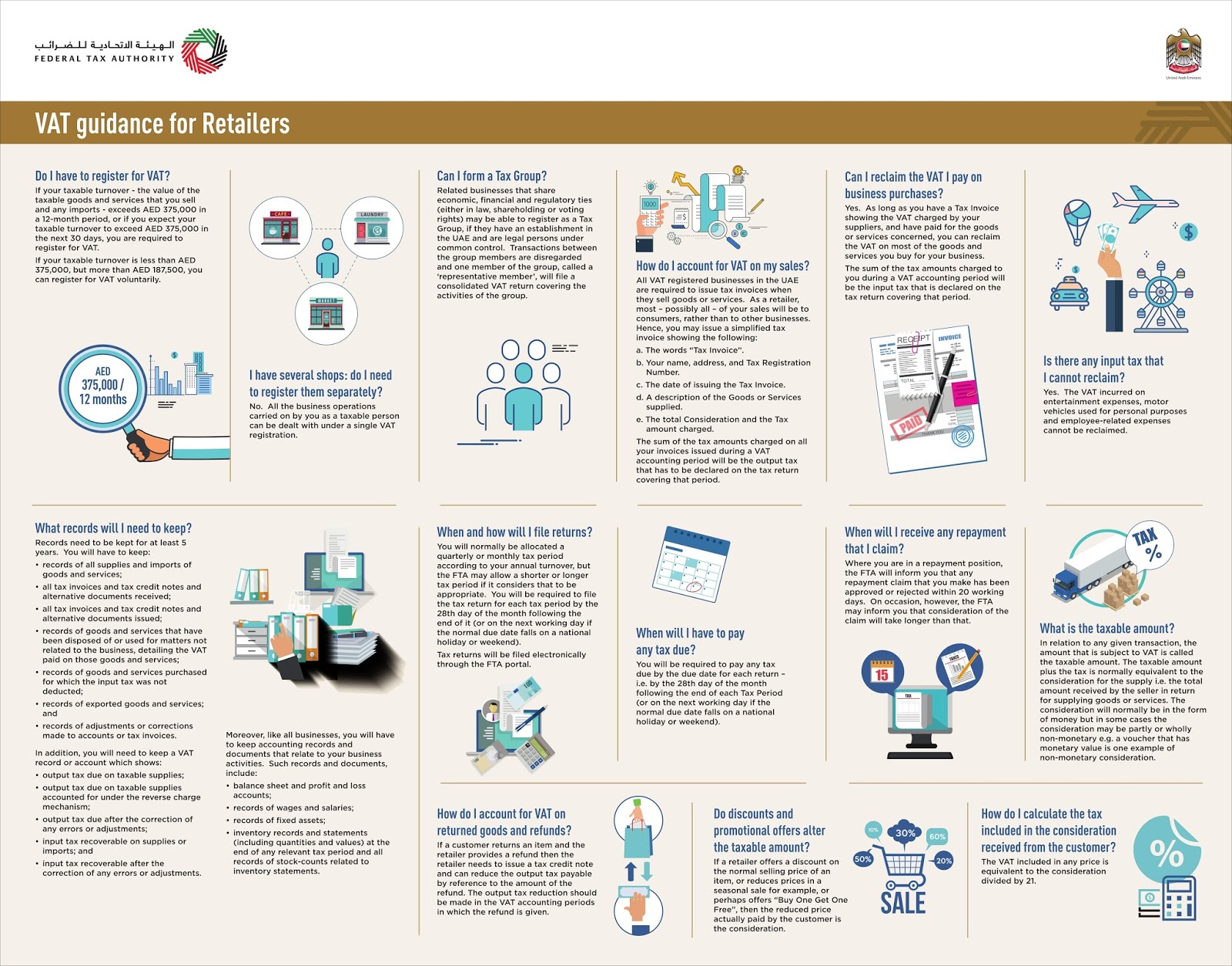

TechVista Systems, a global provider of IT solutions, has successfully assisted Twenty-Two organizations with ensuring compliance with new value-added tax (VAT) regulations. VAT implementation was performed for clients that use Microsoft Dynamics 365, AX 2012, NAV 5, NAV 2013, GP 2013, and GP 2018. TechVista’s team implemented VAT ledgers, standard VAT inquiries, and reports, and updated vendor and customer master data with tax IDs. VAT codes were implemented for 5%, 0%, and exempt status, using all applicable jurisdictions, as well as VAT groups (reverse charge, standard rated, inter-company, exempted, zero-rated supplies, etc.). The team performed SQL collation for Arabic data, and also set up an FTA audit file and VAT return report according to UAE VAT requirements. “Over the past two months, we have partnered with several organizations in the UAE to make sure that their implementation of all VAT rules and regulations takes place smoothly and efficiently,” said Adeel Edhi, ...