Value Added Tax (VAT) guidance for Retailers – VAT in UAE

Value Added Tax (VAT) guidance for Retailers published on Federal Tax Authority website www.tax.gov.ae.

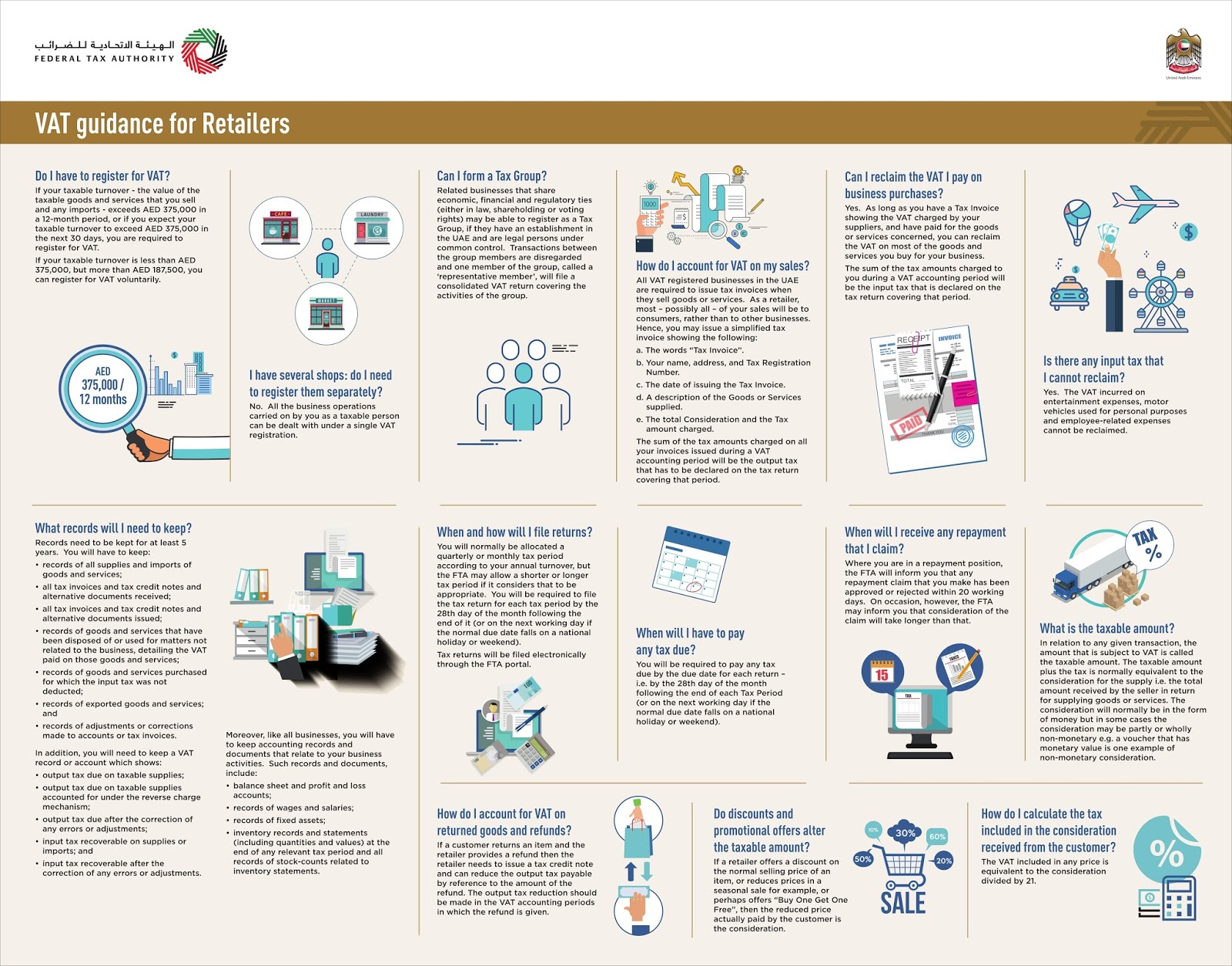

Do I have to register for VAT?

If your taxable turnover – the value of the taxable goods and services that you sell and any imports – exceeds AED 375,000 in a 12-month period, or if you expect your taxable turnover to exceed AED 375,000 in the next 30 days, you are required to register for VAT.

If your taxable turnover is less than AED 375,000, but more than AED 187,500, you can register for VAT voluntarily.

I have several shops: do I need to register them separately?

No. All the business operations carried on by you as a taxable person can be dealt with under a single VAT registration.

Can I form a Tax Group?

Related businesses that share economic, financial and regulatory ties (either in law, shareholding or voting rights) may be able to register as a Tax Group if they have an establishment in the UAE and are legal persons under common control. Transactions between the group members are disregarded and one member of the group called a ‘representative member’, will file a consolidated VAT return covering the activities of the group.

How do I account for VAT on my sales?

All VAT registered businesses in the UAE are required to issue tax invoices when they sell goods or services. As a retailer, most – possibly all – of your sales will be to consumers, rather than to other businesses.

Hence, you may issue a simplified tax invoice showing the following:

- The words “Tax Invoice”.

- Your name, address, and Tax Registration Number.

- The date of issuing the Tax Invoice.

- A description of the Goods or Services supplied.

- The total Consideration and the Tax amount charged.

The sum of the tax amounts charged on all your invoices issued during a VAT accounting period will be the output tax that has to be declared on the tax return covering that period.

Can I reclaim the VAT I pay on business purchases?

Yes. As long as you have a Tax Invoice showing the VAT charged by your suppliers, and have paid for the goods or services concerned, you can reclaim the VAT on most of the goods and services you buy for your business.

The sum of the tax amounts charged to you during a VAT accounting period will be the input tax that is declared on the tax return covering that period.

Is there any input tax that I cannot reclaim?

Yes. The VAT incurred on entertainment expenses, motor vehicles used for personal purposes and employee-related expenses cannot be reclaimed.

What records will I need to keep?

Records need to be kept for at least 5 years. You will have to keep:

- records of all supplies and imports of goods and services;

- all tax invoices and tax credit notes and alternative documents received;

- all tax invoices and tax credit notes and alternative documents issued;

- records of goods and services that have been disposed of or used for matters not related to the business, detailing the VAT paid on those goods and services;

- records of goods and services purchased for which the input tax was not deducted;

- records of exported goods and services; and

- records of adjustments or corrections made to accounts or tax invoices.

In addition, you will need to keep a VAT record or account which shows:

- output tax due on taxable supplies;

- output tax due on taxable supplies accounted for under the reverse charge mechanism;

- output tax due after the correction of any errors or adjustments;

- input tax recoverable on supplies or imports; and

- Input tax recoverable after the correction of any errors or adjustments.

Moreover, like all businesses, you will have to keep accounting records and documents that relate to your business activities. Such records and documents, include:

- balance sheet and profit and loss accounts;

- records of wages and salaries;

- records of fixed assets;

- inventory records and statements (including quantities and values) at the end of any relevant tax period and all records of stock-counts related to inventory statements.

When and how will I file returns?

You will normally be allocated a quarterly or monthly tax period according to your annual turnover, but the FTA may allow a shorter or longer tax period if it considers that to be appropriate. You will be required to file the tax return for each tax period by the 28th day of the month following the end of it (or on the next working day if the normal due date falls on a national holiday or weekend).

Tax returns will be filed electronically through the FTA portal.

When will I have to pay any tax due?

You will be required to pay any tax due by the due date for each return –

i.e. by the 28th day of the month following the end of each Tax Period (or on the next working day if the normal due date falls on a national holiday or weekend).

When will I receive any repayment that I claim?

Where you are in a repayment position, the FTA will inform you that any repayment claim that you make has been approved or rejected within 20 working days. On occasion, however, the FTA may inform you that consideration of the claim will take longer than that.

What is the taxable amount?

In relation to any given transaction, the amount that is subject to VAT is called the taxable amount. The taxable amount plus the tax is normally equivalent to the consideration for the supply i.e. the total amount received by the seller in return for supplying goods or services. The consideration will normally be in the form of money but in some cases the consideration may be partly or wholly non-monetary e.g. a voucher that has monetary value is one example of non-monetary consideration.

How do I account for VAT on returned goods and refunds?

If a customer returns an item and the retailer provides a refund then the retailer needs to issue a tax credit note and can reduce the output tax payable by reference to the amount of the refund. The output tax reduction should be made in the VAT accounting periods in which the refund is given.

Do discounts and promotional offers alter the taxable amount?

If a retailer offers a discount on the normal selling price of an item, or reduces prices in a seasonal sale for example, or perhaps offers “Buy One Get One Free”, then the reduced price actually paid by the customer is the consideration.

How do I calculate the tax included in the consideration received from the customer?

The VAT included in any price is equivalent to the consideration divided by 21.

Your blog provides clear and practical insights into VAT compliance for retailers in the UAE. The breakdown of invoicing, record-keeping, and tax return obligations is especially helpful for small and mid-sized businesses navigating the VAT framework. As the retail landscape grows increasingly dynamic, guidance like this is essential for avoiding penalties and ensuring smooth operations. For those seeking expert support, partnering with a reliable VAT advisory in Dubai can make the compliance process more efficient and stress-free. It would be great to see a future post on how VAT impacts e-commerce and cross-border retailing in the region. Thanks for the informative content!

ReplyDelete